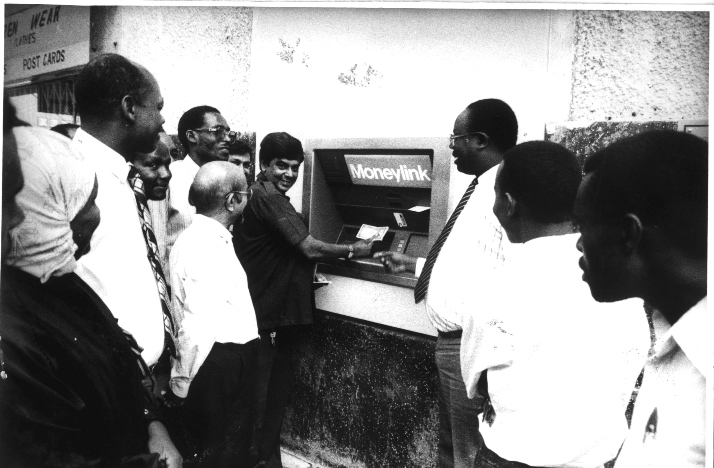

Kenya’s First ATM

Image credit: KBA

As of October 2021, Kenya had about 2,360 Automated Teller Machines (ATMs) in operation. The ATM has saved many busy souls from tediously waiting for a bank teller to become available for cash withdrawal. The whirring of bills fanning out from a machine may amount to nothing but a passing errand now; but on October 2nd 1989, this sound marked the beginning of a new banking era in Kenya.

Computerisation and the first ATMs

Three ATMs became a part of Kenya’s banking industry as part of Standard Chartered’s ‘cash in a flash’ campaign. In a time when the banking industry in Kenya was undergoing computerisation, the campaign promised faster access to banking services. The ATMs rolled out under Standard Chartered’s Moneylink services. The Moneylink logo was emblazoned on the brand-new machines. Moneylink offered banking, financial and insurance services.

Two machines found their homes at the Standard Chartered branch on Moi Avenue. Another was at a branch on Kenyatta Avenue. These two iconic branches were consolidated in August 2021 to form one branch of Standard Chartered on Kenyatta Avenue. It is still operational today.

Staying Ahead of the Curve

The introduction of ATMs created a competitive environment in banking. Standard Chartered had acquired an asset that was not only a spectacle but an effective machine that was easy on the bank’s bottom line. After Standard Chartered unveiled the shiniest new financial innovation in Kenya, other banks in Kenya followed suit. Barclays Bank installed their first ATM in 1995, and soon the Kenya Commercial Bank, Co-operative Bank, NIC Bank and CFC Bank joined the wave.

In 1997, Standard Chartered introduced an ultra-modern Automatic Banking Centre at its Moi Avenue branch. The centre came complete with three of the newest generation ATMs. It became the first-ever automated centre of its kind in Kenya. This branch became revolutionary for offering 24-hour services to clients. It enabled the withdrawal of cash from Current or Savings Accounts both during and after normal bank hours.

The Rapid Spread of ATMs in Kenya

Mr Lindsay Duncan, the Executive Director of Standard Chartered in 1997, reported that usage of the ATMs offered by its Moneylink service had increased by a whopping five-fold since their introduction in 1989. This led the bank to introduce 20 more ATMs to meet demand at its branches. Subsequently, they set up in shopping centres such as ABC Place in Westlands. By the year 2000, there were about 100 fully operational ATMs in Kenya spanning across different banks.

Standard Chartered now has around 108 ATMs spread across Kenya. This banking giant provides living proof of the power of innovation. The demand for faster and more accessible banking services led the bank to pioneer one of the most significant technological developments in Kenyan banking. ATMs remain a vestige of safe and secure banking in Kenya. The elated faces of those who witnessed money appear from seemingly nowhere serve as a reminder that the first ATM was an incredible advancement that changed banking in Kenya forever.