Kenya Commercial Bank

Kipande House. Image sourced from Pinterest

Kipande House. Image sourced from Pinterest

The aftermath of the Second War reverberated in a myriad of sectors including banking. British banks operating overseas started a series of mergers in order to stay afloat. In 1948, the National Bank of India acquired capital of Grindlays Bank, which mainly operated in India. Under the terms of this acquisition Grindlays Bank retained its identity and management. Ten years later a merger ensued, and the two banks became National Overseas and Grindlays Limited. The name changed once more in 1959 to National and Grindlays in order to omit the reference to geographical location.

Banking for Africans

The 1960s were full of changes that the bank needed to adapt to. The first blow came in 1966, when the newly established Central Bank of Kenya took over the government account managed by the bank for years. The next change major change happened in 1969, when an amendment to the 1967 Immigration Act stipulated that all professionals and supervisors working in Kenyan banks needed to apply for entry permits or dependents passes. This began an exodus of Asians who lived and worked in Kenya, forcing the bank to begin training its own Kenyan staff.

The winds of change blew yet again in 1970 with the establishment of the Kenya Commercial Bank (KCB) Limited. This new bank took over 78 of the 81 National and Grindlays Bank branches. Under KCB, the government was a 60% shareholder while National and Grindlays Bank retained 40% ownership. The remaining three branches came under a new company called Grindlays International Bank Limited. The Kenya Commercial Bank was inaugurated on November 12, 1970. It adopted the motto, Being Closer to the People, and took on the insignia of the lion which is a symbol of independent Kenya.

Your Country, Your Bank

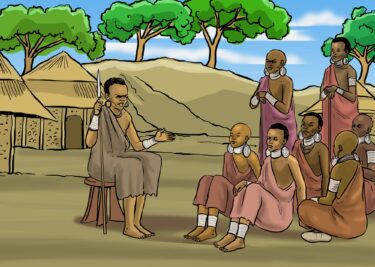

Because of all the changes that the bank underwent in the spirit of Kenyanization, KCB was very intentional about increasing their African client base. For decades, banks did not prioritize Africans. Many faced rejection when they tried to open bank accounts. As a result, they resorted to storing money in secret nooks in their homes. To counter this, KCB started a targeted campaign with the slogan, Nchi hii ni nchi yako, benki hii ni benki yako (This is your country, this is your bank). The bank reached out to Africans on a large scale and implored them to open accounts to ensure the safety of their money. The campaign was a huge success and marked a key milestone in the bank’s growth. As KCB ushered in this new era of service to Africans, it was rewarded with new customers and an increased number of deposits.

New Frontiers

The coffee boom of 1975 was a financial goldmine that led to even more African farmers opening bank accounts. KCB experienced growth in leaps and bounds during this period. In 1976 the bank purchased Kipande House where it opened a new branch two years later. Previously known as Nayer Building, the building was constructed in 1910 to serve as a warehouse. It later became a compulsory labour registration centre for Africans who worked on the farms of white settlers. After independence, it became the National Registration Bureau’s office for issue of identity cards (kipande), hence the origins of its current name.

From Strength to Strength

In 1977, KCB erected its new headquarters on Government Road. The eight-storey building called Kencom House took four years to complete. It was the largest commercial office block in Nairobi at the time. Once completed, the bank transferred its initial Government Road branch into the new building. These premises served as the headquarters for over fourty years. Ready for bigger and better in 2009, the bank occupied its new home in KCB Towers – Upperhill.

The Kenya Commercial Bank has continued to grow over the years, currently boasting over 200 branches nationwide. Its growth is seemingly synonymous with our national history through the years, and it remains rooted in its mission to be closer to the people.