The History of Tax in Kenya

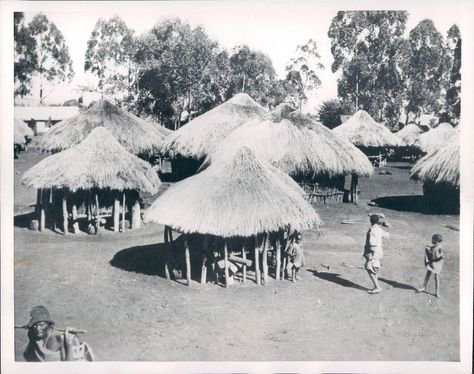

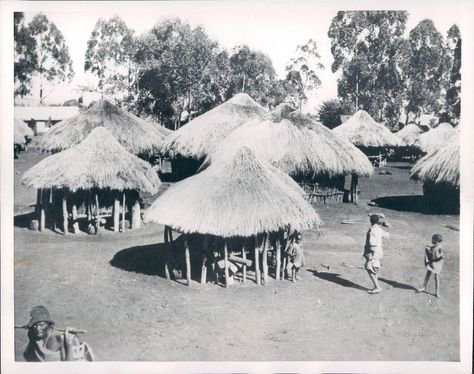

Huts in the colonial era

The story of currency cannot be told without discussing the history of taxation in Kenya. Long before colonization, land was communally owned. All members shared in the community’s wealth. However, in most communities, an agreed amount from crop harvest or profit from trade acquired was remitted to the community chief’s house. Payment, referred to as tithe, was expected by local and foreign traders who would pass through community lands on their way to their trading destinations.

When the Arabs explored the E.A Coast, there was the opportunity to settle. However, it wasn’t until the Sultanate relocated from Oman to Zanzibar that more Arabs followed suit. The Sultanate’s governate was placed in further north of his new residence, in Malindi. With more Arabs settling along different places, the governate allowed each of the coastal locations inhabited to run their own affairs and collect taxes for the Sultan. Taxpayers were divided into: citizenry within each Sultanate and the traders. Rates were fixed without exception for all subjects of taxation.

Population grew steadily through intermarriage and this contributed to the creation of the Swahili language. Though, with change in times and competition among traders growing frequent, the people formed themselves into Sultanates, each jealously guarding their territories. They constantly fought each other to control trade within the interior and even rebelled against the Sultan’s leadership.

When the British arrived and explored the interior, more changes followed. A British Colonial tax policy was created on the grounds that Britain needed to support its own economy by creating foreign markets and sources of raw materials for her industries. The idea of direct African taxation was proposed by British Commissioner, Sir Arthur Hardinge. It was a scheme of tax collection that would be steadily imposed, beginning along the railway centres from Mombasa to Machakos.

The Native Hut Tax was the first to be inflicted in 1901 under the Hut Tax Regulations of that year under the stewardship of Commissioner Sir Charles Eliot. In this regulation, all huts used as dwellings were expected to pay 1 Rupee annually. The British were commencing a journey to an ultimatum and began by encouraging the locals to work for white settlers and understand the value of money. With assurance of some superiority, European settlement followed in 1902. The settlement in the colony further became a handsome idea when the Crown Lands Ordinance of that year declared that all land in the protectorate belonged to the British Imperial Government and it would be allocated at will. However, this move initiated the forceful alienation of indigenous Kenyans from their land. To further scatter the Africans from their land, the railway station points had higher Hut Tax rates of 2 Rupees, and by 1903, the general Hut Tax had increased to 3 Rupees.

Huts in the colonial era

Poll Tax followed at the end of the 20th century’s first decade under the Hut and Poll Tax Ordinance of 1910 in order to prevent the circumvention of Native Hut Tax. Hardinge imposed this on anyone not covered by Hut Tax, specifically African males 25 years and older. The system of forced labour such as road and building construction was introduced to those that could not pay tax. This same year, African women who owned huts were included in the obligation to pay Hut Tax.

Tax Collection was administered by community chiefs and headmen who would report to District Commissioners under the British Administration. When there was failure to comply, the tax collection process was violent, with use of force and coercion. The Kamba, Kikuyu, Nandi and Keiyo were some of the earliest victims of forced taxation in form of cash.

Koitalel arap Samoei who led Nandi resistance

3 Comments

A very informative article with clearly illustrated ideas

Shukran Charles, and thank you for reading.

great article.. we are back to where we were, 120 yrs back.