Barclays Bank

Image credits: Kenya Bankers Association

Image credits: Kenya Bankers Association

The Ever-Evolving Absa Bank

The bank that we now know as Absa is no stranger to change. Before Absa took on its present name, a series of mergers and transformations developed the bank into the familiar financial institution we know today. The beginnings of this powerhouse bank go back, before Kenya’s inception, and marked the genesis of a 105-year presence in the world of Kenyan banking.

A New Bank and a New Colony

In 1916, the National Bank of South Africa (NBSA) was set up in Kenya. NBSA operated in South Africa before it was established in Kenya, hence its name. It now goes by the name First National Bank. The first NBSA branch opened in Mombasa. NBSA’s introduction in Mombasa is no surprise given the coastal region’s vibrancy and position as the first main port of the East African Protectorate.

In 1920, the East African Protectorate became an official colony of the British Empire. Its name changed to Kenya. After Kenya gained colony status, British officials aimed to encourage Britons to become settlers in Kenya by taking up residence on lands confiscated from Africans.

Growth Through Settler Deposits

Banks implemented a strategy to improve the local economy using settler presence. These banks such as NBSA were actually British banks operating in colonies like Kenya in order to track the development of trade in the colonies as well as monitor international trade.

Therefore, the presence of British banks such as NBSA in Kenya provided financial links to Europe and served the traders and settlers who were residing in Kenya. Africans did not have access to banking services at NBSA and could only access saving services provided by Postbank from 1910. Banks such as NBSA grew substantially from new deposits by settlers. The monies that settlers brought with them and the proceeds gained from lucrative trade provided an influx of deposits as NBSA found its feet. Soon enough, the bank found itself collecting a surplus of deposits, more than it was able to use in Kenya. This led to the bank exporting monies for use in London.

The Merging of Two Banks

In 1925, NBSA merged with the Anglo-Egyptian Bank and the Colonial Bank. The result was a private subsidiary of Barclays Bank Limited called Barclays Bank DCO (Dominion, Colonial and Overseas). The Anglo-Egyptian Bank was an independent bank founded in 1864. It was then acquired by Barclays in 1920. The bank had a presence in Palestine, Sudan, the Mediterranean and Egypt. After the merger, Barclays took over all three branches of NBSA that were then in operation in Kenya.

A Growing Barclays

Barclays bank experienced a boom in clerical staff between 1945 and 1960. The staff numbers ballooned from 283 to 1,163 – a testament to the growth of the bank in Kenya. In 1951, on Queensway Street (Kaunda Street), Barclays erected a building that took the crown of the tallest building in East Africa at the time. This bastion of modernity was home to the bank’s main branch and head office in the colony of Kenya. The building featured unseen modern amenities such as elevators, fluorescent lighting and telephone communication.

Accessibility for Africans

By 1953, Africans had gained access to general banking services and Barclays underwent a gradual rebranding to shift towards a banking sector that was more open to serving Africans. A lack of regional cash centres meant that Barclays staff would transport monies physically from Nairobi.

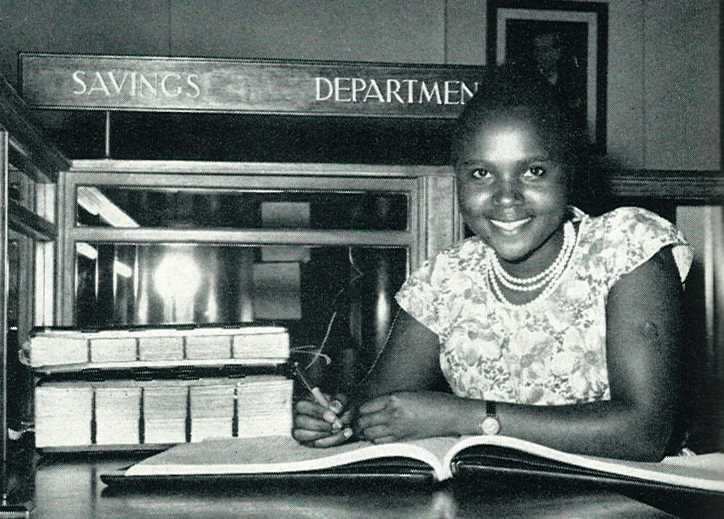

In 1954, the bank changed its name to Barclays DCO in order to reduce the imperial tones that came with the unabbreviated name. Rosemary Mwangi Njoki became the first female clerk in Kenya. Her employment began in 1959 at Barclays DCO, Government Road Branch.

Another name change came in 1971 as Barclays DCO became Barclays Bank Intenational (BBI). Barclays shed its skin once more and became incorporated as Barclays Bank Kenya (BBK) in the early 80s. The newly incorporated BBK appointed its first chairman. Sam Waruhiu, the Kenyan son of a chief, became the chairman of Barclays. Waruhiu was a key advocate of the Africanisation of industry and also chaired Old Mutual.

From Barclays to Absa

Barclays went from strength to strength and claimed the title of the first Kenyan bank to offer public shareholding on the Nairobi Stock Exchange (NSE) in 1986. Barclays floated 30% of its equity to a public all too willing to snap the shares up. In fact, the shares were oversubscribed by a jaw-dropping 6 times.

Effective 10 February, 2020, Barclays Bank officially became Absa Bank. A bold and vivid kaleidoscope of Absa reds replaced the elegant cerulean blue and iconic eagle that represented Barclays Bank. Absa coined the term ‘Africanacity’ to explain the spirited new branding for the Barclays Africa Group. The term refers to the ability for Africans to always find solutions. The Absa logo features a white circle surrounding welcoming lowercase letters, almost as if subtly acknowledging the full circle moment of a bank that initially offered no services to Africans now having African-centred branding.

Absa Bank witnessed the genesis of Kenya itself and became a fearsome leader in the banking sector. The bank remained abreast of political and social changes taking place in Kenyan throughout and opened the door for some of the first African banking staff in the history of Kenya. Although Absa has had many names, what has remained unchanged is its position as a key part of Kenya’s banking history.